Nigeria external reserves remain a lifeline for the economy because they provide stability during periods of uncertainty. Strong reserves allow the country to absorb shocks, manage risks, and maintain investor confidence even when global markets fluctuate. This truth is especially relevant for oil-dependent Nigeria, which relies heavily on imports for foreign exchange. Therefore, effective and efficient management of external reserves becomes not just important but absolutely essential.

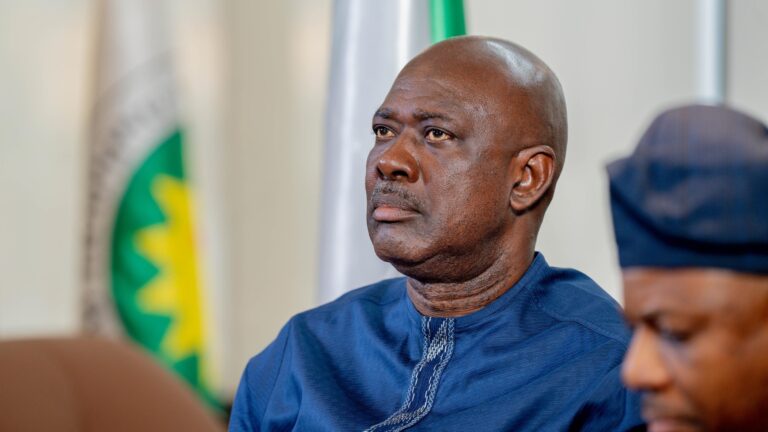

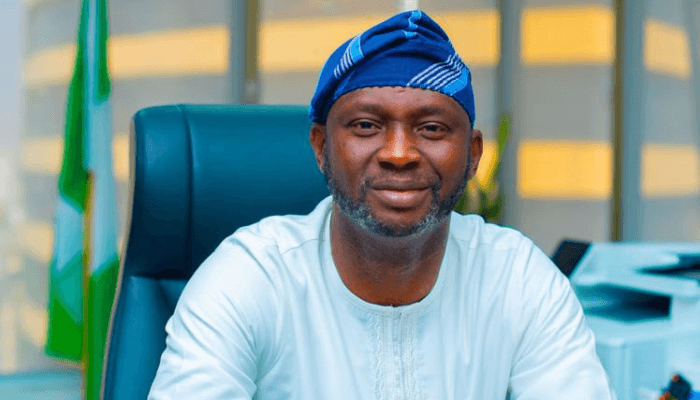

Since assuming office on September 15, 2023, Central Bank Governor Olayemi Cardoso has recognized this responsibility. He has taken deliberate steps to ensure steady growth in Nigeria reserves, knowing that stronger buffers reduce sovereign risk and improve credit ratings. Moreover, his approach demonstrates a deep understanding of how financial credibility translates into broader economic resilience. Investors observe reserves as a signal of stability, and therefore, every increase strengthens Nigeria’s negotiating position globally.

Read more: Egypt’s Richest Man Nassef Sawiris Plans $50bn Investment In US Infrastructure

Transitioning into this role was never going to be easy. The Nigerian economy had been grappling with inflation, fluctuating oil revenues, and capital flight. However, Cardoso’s clear strategy has focused on building trust and restoring discipline in reserve management. He continues to implement policies designed to attract foreign inflows, stabilize the naira, and support fiscal sustainability. Furthermore, his administration has emphasized transparency, which helps both domestic and international stakeholders monitor progress with confidence.

Meanwhile, the global economic landscape has been turbulent. Oil prices have shifted unpredictably, while international borrowing costs have risen sharply. Countries without strong reserves have struggled to meet obligations, often sliding into deeper crises. Nigeria, however, is working hard to avoid such vulnerability. By focusing on reserve growth, the CBN positions the country to withstand external shocks more effectively. Consequently, both sovereign ratings and investor perceptions improve, which lowers borrowing costs and attracts greater investment.

In addition, well-managed reserves provide confidence to businesses and households. When reserves are strong, the central bank can stabilize currency volatility, ensuring smoother trade and investment. This stability encourages companies to plan with greater certainty, which ultimately drives economic growth. Households also benefit because stable reserves reduce the risk of sudden inflationary pressures caused by currency depreciation. Therefore, Cardoso’s deliberate focus extends beyond financial charts and directly impacts everyday Nigerians.

Furthermore, the Governor’s efforts highlight a broader truth: managing reserves is not about numbers alone. It is about credibility, confidence, and foresight. A country with weak reserves appears risky, discouraging capital inflows and partnerships. By contrast, strong reserves attract cooperation, enhance creditworthiness, and reduce vulnerabilities. Cardoso clearly understands this connection, which is why he prioritizes sustainable accretion instead of short-term fixes. His deliberate approach reflects a long-term vision rather than reactionary decisions.

Cardoso’s leadership also underscores the link between reserves and sovereign risk. Credit rating agencies examine reserves when assessing a country’s ability to meet obligations. Therefore, growing reserves enhances Nigeria’s financial standing internationally. As these ratings improve, borrowing becomes cheaper, and opportunities for investment expand. This cycle reinforces itself, making the economy more resilient with each improvement.

Ultimately, Nigeria external reserves represent more than stored currency. They symbolize trust in the nation’s ability to weather storms. Cardoso’s deliberate actions since 2023 highlight a renewed determination to rebuild resilience and restore confidence. While challenges remain, the strategy of steady accretion offers hope for lasting stability. Nigerians can therefore look forward to an economy better prepared for uncertainties and more attractive to global investors.