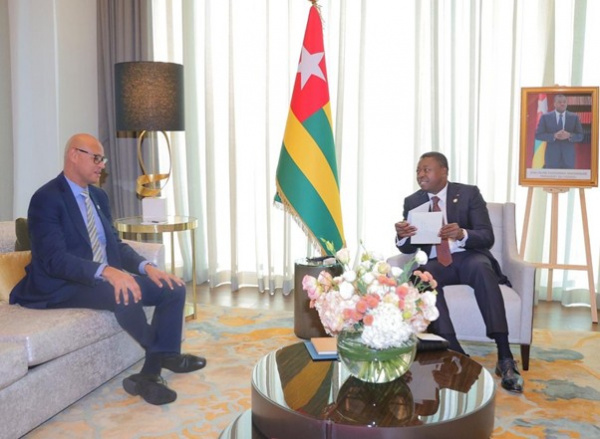

The partnership between Ecobank and Togo continues to grow stronger as both parties reaffirm their shared vision for sustainable development. During the Trade and Investment Forum in Abu Dhabi on November 10, 2025, President Faure Gnassingbé met with Jeremy Awori, Managing Director of Ecobank Transnational Incorporated (ETI), to explore new strategies for accelerating Togo’s economic transformation.

Headquartered in Lomé, Ecobank stands as one of Togo’s greatest financial assets. Its presence has not only boosted confidence in the local banking industry but also positioned Togo as a regional financial hub. The recent dialogue highlighted the Group’s ongoing commitment to national priorities, including financial inclusion, industrialization, and cross-border trade expansion.

The conversation between Ecobank and Togo leadership focused on how the bank can further align its operations with the government’s development agenda. By deepening investment in key sectors and supporting innovative financing models, Ecobank aims to strengthen its role as a catalyst for inclusive growth. The bank’s efforts continue to empower small businesses, modernize industry, and stimulate regional integration.

Moreover, President Faure Gnassingbé emphasized the importance of strong partnerships between financial institutions and the state. He praised Ecobank’s consistent support for entrepreneurship and digital innovation, noting how such initiatives create jobs and empower local communities. He reaffirmed his government’s commitment to policies that foster a stable business climate and attract more investments.

Jeremy Awori, for his part, expressed Ecobank’s pride in contributing to Togo’s progress. He outlined the Group’s determination to intensify its efforts in financing infrastructure, promoting digital banking, and advancing women-led enterprises. These actions, he said, align perfectly with Togo’s ambition to become a hub for innovation and sustainable trade in West Africa.

Additionally, the partnership seeks to expand access to affordable credit and digital financial services. Through mobile platforms and microfinance initiatives, Ecobank aims to bring banking closer to underserved populations. This approach not only enhances inclusion but also builds financial literacy and resilience among entrepreneurs and rural communities.

The collaboration also reinforces Togo’s position in regional trade networks. As cross-border commerce grows, Ecobank provides the financial infrastructure that connects markets and supports exporters. These efforts strengthen integration within the African Continental Free Trade Area (AfCFTA), helping Togo harness new opportunities for industrial growth and value creation.

Furthermore, Ecobank’s commitment extends to supporting sustainable finance and green projects. By investing in renewable energy, agriculture, and climate-smart initiatives, the bank contributes to both environmental protection and economic resilience. This aligns with President Gnassingbé’s broader vision of sustainable development and inclusive prosperity.

The meeting in Abu Dhabi showcased more than cooperation—it symbolized confidence, continuity, and a shared belief in Africa’s potential. With clear strategies and mutual trust, Ecobank and Togo are building a model for how public-private collaboration can drive progress across the continent.

Ultimately, the strengthened partnership promises a brighter economic future. Together, Ecobank’s financial leadership and Togo’s visionary governance can unlock new pathways for innovation, inclusion, and long-term prosperity—positioning Togo as a rising beacon of growth in West Africa.