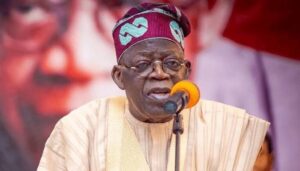

President Bola Tinubu is set to sign four crucial tax bills into law on Thursday, a landmark move the Presidency hails as a significant step towards modernizing Nigeria’s fiscal and revenue operations. This legislative action aims to streamline tax administration, enhance revenue collection, and create a more transparent and efficient tax system that fosters economic growth and stability.

The four bills poised to become law are:

- The Nigeria Tax Bill: This bill likely contains amendments and updates to existing tax laws, clarifying provisions, closing loopholes, and aligning the tax code with current economic realities.

- The Nigeria Tax Administration Bill: This bill focuses on improving the efficiency and effectiveness of tax administration processes, including tax assessment, collection, enforcement, and dispute resolution. It likely introduces measures to simplify tax compliance, reduce administrative burdens, and enhance taxpayer services.

- The Nigeria Revenue Service (Establishment) Bill: This bill likely establishes or strengthens the legal framework for the Nigeria Revenue Service (NRS), empowering it to operate more effectively and independently in collecting government revenue. It may grant the NRS greater autonomy, enhance its enforcement powers, and improve its capacity to combat tax evasion and corruption.

- The Joint Revenue Board (Establishment) Bill: This bill likely establishes a Joint Revenue Board, a body designed to coordinate revenue collection efforts between different levels of government (federal, state, and local). This aims to eliminate duplication of efforts, improve revenue sharing mechanisms, and ensure a more equitable distribution of resources across the country.

These bills were passed by the National Assembly after thorough and extensive consultations with various interest groups, including tax experts, business leaders, civil society organizations, and government agencies. This collaborative approach ensures that the reforms are well-informed, balanced, and responsive to the needs of all stakeholders.

By signing these bills into law, President Tinubu is demonstrating a clear commitment to fiscal responsibility, economic reform, and good governance. These measures are expected to:

- Increase Government Revenue: By improving tax collection efficiency and reducing tax evasion, the reforms are expected to significantly increase government revenue, providing more resources for public services and infrastructure development.

- Promote Economic Growth: A more efficient and transparent tax system will create a more favorable investment climate, attracting both domestic and foreign investment and stimulating economic growth.

- Enhance Fiscal Stability: By diversifying revenue sources and improving revenue management, the reforms will enhance Nigeria’s fiscal stability and reduce its dependence on volatile oil revenues.

- Improve Public Services: Increased government revenue will enable the government to invest more in essential public services such as education, healthcare, and infrastructure, improving the quality of life for all Nigerians.

- Reduce Corruption: By streamlining tax administration and enhancing transparency, the reforms will help to reduce corruption and improve accountability in the management of public funds.

President Tinubu’s decision to modernize the tax system through these four key bills represents a bold and decisive step towards building a stronger, more prosperous, and more equitable Nigeria. These reforms are expected to have a far-reaching impact on the nation’s economy and its citizens, paving the way for sustainable economic growth and improved living standards for all. The success of these reforms will depend on effective implementation, strong enforcement, and continued collaboration between government, the private sector, and civil society.