The Togo securities issue marks another decisive step in the nation’s mission to strengthen its financial base and sustain growth. As part of its plan to raise 100 billion CFA francs in public savings on the WAEMU regional financial market, Togo has announced a new 30 billion CFA franc issuance. The operation is set to close on November 13, 2025, signaling confidence and fiscal discipline.

This latest initiative demonstrates the government’s firm commitment to sound financial management and transparent public financing. The Ministry of Economy and Finance will execute the operation through a simultaneous offering of Treasury Bills (BATs) and Treasury Bonds (OATs). This balanced approach meets short-term liquidity needs while supporting long-term investments, ensuring stability across all financial fronts.

The Togo securities issue also reflects growing confidence in the country’s economic outlook. Investors across the West African Economic and Monetary Union (WAEMU) region continue to show strong interest in Togo’s reliable and well-structured debt instruments. This consistent trust underscores the credibility of the nation’s fiscal policy and its determination to deepen market integration.

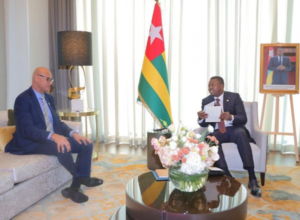

Moreover, the decision aligns perfectly with President Faure Gnassingbé’s broader vision for financial inclusion, economic diversification, and sustainable growth. His administration continues to leverage capital markets to fund public projects, stimulate innovation, and foster regional cooperation. Through these efforts, the government ensures that both the state and private sector share in national progress.

By mobilizing savings within the regional market, Togo is empowering citizens and institutions to invest directly in development. Each issuance creates opportunities for secure participation while strengthening public confidence. In turn, the funds raised support infrastructure, industrial expansion, and improved public services that uplift communities and drive productivity.

The WAEMU financial market remains a crucial platform for fiscal resilience. Through consistent and transparent operations, Togo has built a reputation for reliability and accountability. Its active engagement in the market continues to encourage liquidity, attract investors, and reinforce its image as a dependable economic partner within the region.

Furthermore, the new issuance contributes to deepening the region’s capital market. As demand for stable investments increases, Togo’s initiatives foster innovation, competition, and financial inclusion. The dual structure of Treasury Bills and Bonds gives investors flexibility to align their investments with personal or institutional goals.

Financial analysts describe the Togo securities issue as a strategic move that will fortify public finances and enhance economic resilience. Many believe Togo’s consistent presence in the WAEMU market helps optimize debt management while preserving macroeconomic stability.

Additionally, proceeds from the operation will support national projects in energy, infrastructure, and social development. These initiatives will create employment, strengthen rural economies, and sustain growth momentum.

In a broader sense, Togo’s continued participation in the regional market highlights its leadership and fiscal maturity. Each successful operation strengthens its financial credibility and sets a benchmark for effective governance across West Africa.

Ultimately, the Togo securities issue represents more than a financial transaction. It stands as a symbol of vision, discipline, and national confidence. By aligning strategic ambition with economic responsibility, Togo continues to lead the path toward inclusive, stable, and sustainable development across the WAEMU region.